Very recently I had the change to listen to several pitches presentations and I understood many of the critics VCs and Angels say about them. When you’ve listen to 3 in a row you start to see a pattern. The following are a couple of lessons I learned by doing my own pitch and listening to the rest.

- Do NOT add a balance sheet and/or cashflow analysis slide if you haven’t been asked for. First of, the slide will probably be crowded with numbers which the VCs won’t have time to read. Secondly, balance sheets should be in the business plan so there is no need to show them in a 20min pitch. And finally, adding that information is just looking for problems. If by any chance you screw up your numbers (which you have a fat chance to) and a VC notices it you’ll won’t look good.

- Add the amount of investment you are looking for and from whom. This was my personal bad, I forgot to add a slide with the amount I needed to start my company and what type of investors I was looking for. Theoretically you wouldn’t need to add the type of investor as if you are pitching to one, you’ve already chosen, but in my case it was an heterogeneous jury so I got asked.

- Ugly presentation design does matter. A presentation pitch isn’t just some random slides where you show your business idea, it’s your brand. In the same way you carefully choose your cloths (or at least you should) when giving a presentation, you should carefully choose your slide design. Please, avoid using canned designs, when you listen to 10 presentations a day, trust me, you can tell when it’s canned. Avoid using ugly color combinations like blue background with yellow letters or standard MS Word titles (yeah, you know which ones I mean, the rainbow title!). And for god sakes, don’t use pixalated images.

- Answer the question. This might seem straightforward but what I saw is that most of the time, the CEO is so nervous that when asked a question they answer something completely different with no connection what so ever with what they had been asked. This makes you look bad, makes you look as if you didn’t listen or didn’t understand the question, or both.

- Don’t tell the story of your company. I’m sure you wrote it in the business plan, no need to add a slide about it. Investors want to hear the problem and the solution, not your fancy background which I’m sure it’s interesting, but not for a 20min pitch.

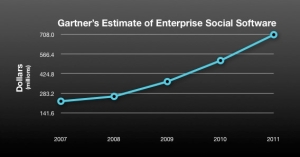

- Do NOT show fancy market size graphs. This is something Guy Kawasaki stresses and I agree with him. All presentations tend to have a slide with a graph from _insert_your_favorite_analyst_firm_here_ with the market size which, of course, is always huge and getting bigger. Simply, don’t. Throwing some numbers isn’t bad, but please, be original and avoid the “the market is huge and growing” song. And do yourself a favor and avoid any mention to the infamous “” if you don’t have detailed information to back it up.

I have to say I learned a lot by watching a couple of pitches and I now understand why VCs say what

they say. Most presentations are identical, same structure, same market charts, same texts. Be original and listen carefully to VC questions and suggestion, it will help you get better with your

presentations, at least it worked for me.

Want to add another point? Please leave a comment! And remember, if you like this blog, subscribe to the RSS feed here.